With the value of equipment currently at historic highs, it is the perfect time for business owners in this situation to seek formal sworn valuation of their equipment and potentially raise an asset revaluation to strengthen their balance sheet.

There is a transition happening in business, where baby boomers are reaching retirement age and can either:

- Sell their business to a competitor

- Sell part or all of their interest to key employees

- Undertake formal succession to the next generation

In this blog, we explore these elements in greater detail, however we would like to note that this should not be taken as financial or tax advice and in every instance business owners should speak to their tax accountant or corporate advisor before taking any action.

Baby boomers retirement surge

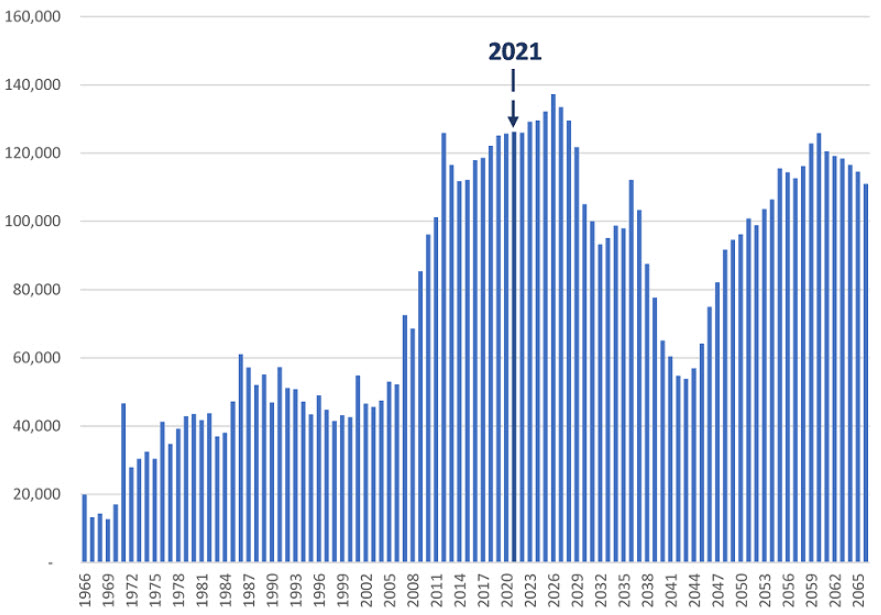

We are well and truly in the midst of the transitioning of baby boomers reaching retirement age, with 2021-2027 representing the peak years of the Australian baby-boom retirement surge.

The number of people reaching the “retirement age” of 65+ in Australia has increased over time, with only 40,000 reaching 65 in the 1990’s versus 126,000 in 2021. But the peak isn’t expected until 2026, where 137,000 baby boomers will reach retirement age. See more details in the graph below.

Boomer’s retirement mountain: net annual change in Australian population 65+, 1966-2066

Image source: Firstlinks

Image source: Firstlinks

With more baby boomers reaching retirement age, we should expect to see this reflected in business, with business owners either:

- Selling their business to a competitor;

- Selling part or all of their interest to key employees; or

- Undertaking formal succession to the next generation.

Value of equipment at historical highs

The value of used equipment has been stimulated by the ongoing effects of COVID.

According to Pickles, auction clearance rates of used transport equipment (including prime movers, line haul trailers and Japanese trucks) are at a 10 year high and have been for 12 months.

On top of this, used earthmoving and construction equipment “has lifted some 20% just this year”.

A sales example provided by Pickles is a 2016 Case 13 tonne excavator that sold for $80,000 pre COVID, sold for $116,000 in March 2022.

The value of business equipment can change on a regular basis, depending on what is happening in the world and how these events impact the market. Some of the factors which have caused the current increase in equipment value include:

OEM Supply Chain Issues

The market demand is increasing but this demand is unable to be met due to OEM supply chain issues. In some cases, there is up to a 12 month wait for equipment to arrive.

Part and Components

A lack in parts and components is the leading issue to supply.

Low Used Stock Availability

Due to supply issues, many businesses are holding onto their equipment once the lease ends, so there are fewer used equipment options available.

Desirability of Assets

Due to the lack of supply, business assets are highly sought after, hence businesses are willing to pay more for used equipment than they were previously, as explored by Pickles.

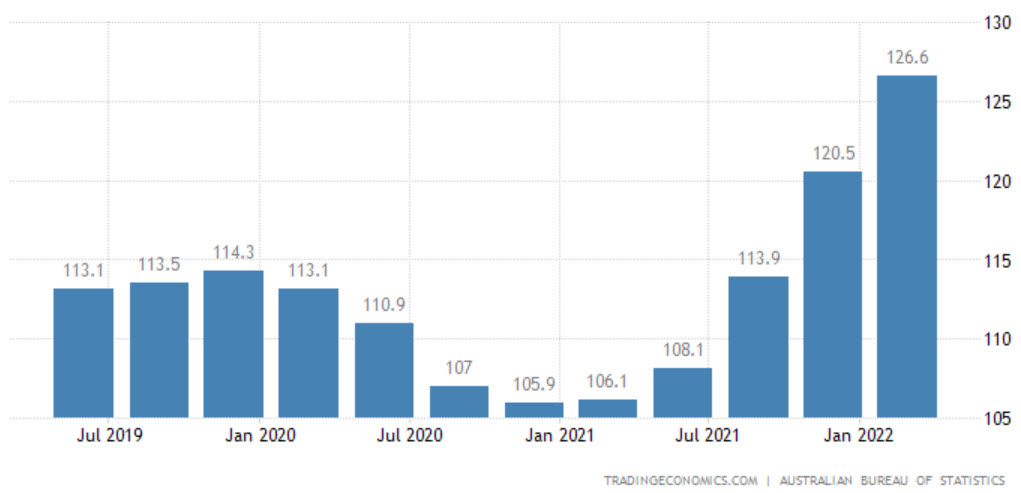

Import Prices

According to the Australia Bureau of Statistics, “Australia’s import prices rose by 5.1 percent quarter-on-quarter in Q1 of 2022, after a 5.8 percent gain in Q4 which was the steepest pace since Q4 2008. The latest figure represented the fifth straight quarter of growth in import prices, amid a further recovery in the economy from the COVID-19 crisis and soaring energy prices.”

Australia Import Prices Jul 2019 – Feb 2022

Image source: Trading Economics/ABS

Accounting for changes in market value of business assets

With the value of equipment at historical highs, business owners, whether retiring or not, should look into seeking formal sworn valuation of their equipment and potentially raise an asset revaluation.

There are two methods used to account for changes in the value of a business’s fixed assets.

Cost Model

The cost model is one of the most straightforward accounting approaches. This method accounts for a company’s fixed assets by carrying them at their historical costs, minus any accumulated depreciation or impairment losses over time as well.

Revaluation Model

The revaluation method is where the carrying value of a fixed asset can either increase or decrease depending on the market value of it. This helps to present a more accurate financial picture of a business when compared to the Cost Model.

Please note: In every instance, business owners should speak to their tax accountant or corporate advisor before taking any action.

Benefits of knowing the market value of business assets

Knowing the market value of your business equipment comes with many benefits including:

- Strengthen your balance sheet

- Could be used as equity to leverage off for the banks

- Could be used to raid funds to buy-out a retiring director

- Plus more.

Secure your future plan with Ledge

If you are a business owner reaching retirement and want to know your options, contact your Ledge Finance Executive. We work with a number of exceptional business advisors who can help to ensure a smooth transition to retirement. Alternatively, if you already have a tax consultant, business advisor or the like, we can work alongside them to reach an ideal outcome.

Give us a call on (08) 6318 2777, or fill in an online enquiry form, and we will get back to you as soon as possible.