As businesses across Australia navigate a challenging economic landscape, rising costs are becoming increasingly concerning, especially for commercial property rentals.

This presents an opportunity for business owners to rethink their property strategies. Purchasing commercial property could unlock various long-term advantages for your business.

Rising CPI & Commercial Property Rentals

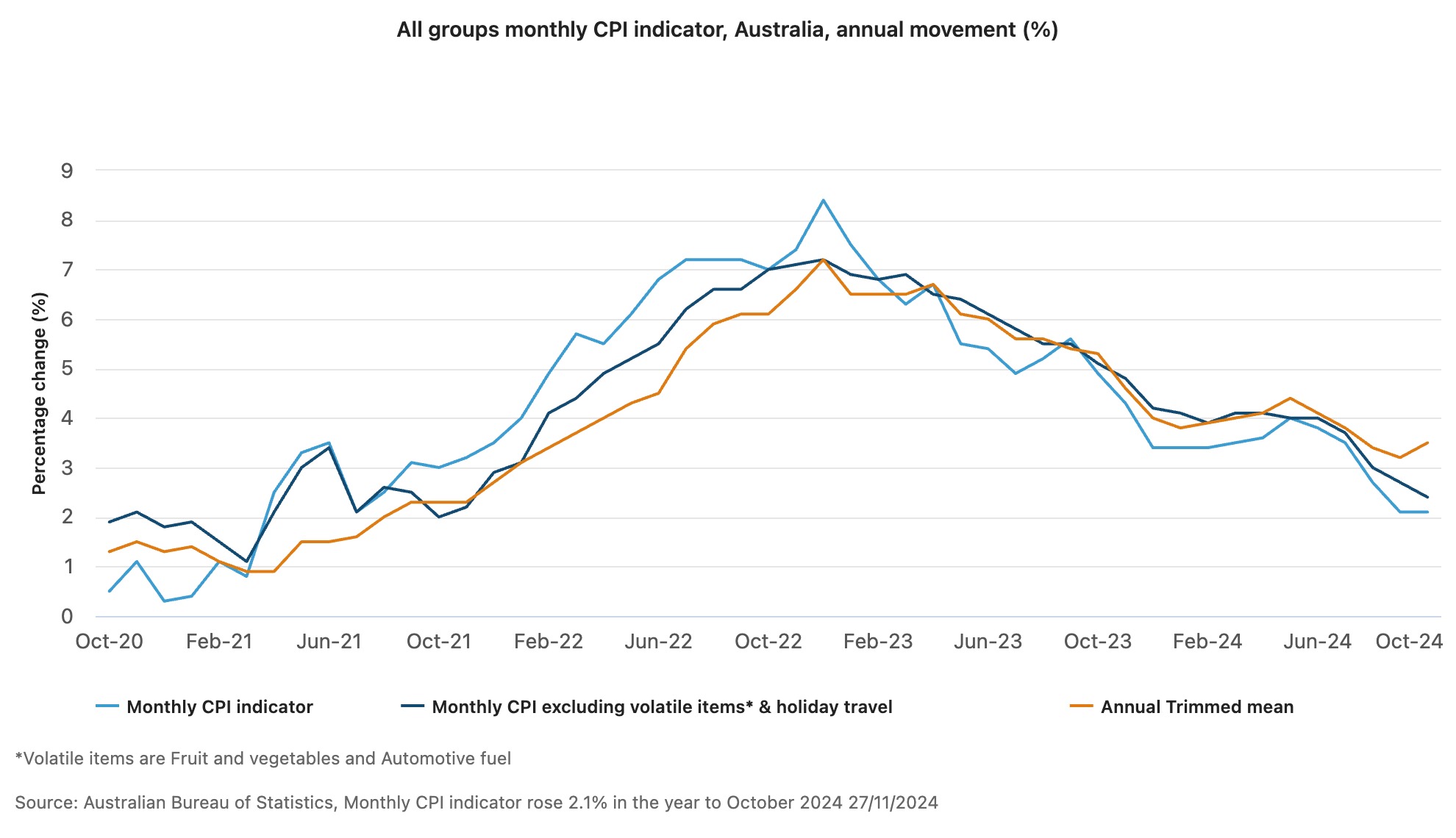

One key driver is the steady climb in the Consumer Price Index (CPI), which measures inflation.

Headline inflation was 2.8% over the year to the September 2024 quarter; however, the figure can feel higher when factoring in supplementary government measures like power bill support. Underlying inflation was 3.5% over the year to the September quarter, which is some way from the 2.5% midpoint of the inflation target set by the RBA.

This high-CPI environment impacts rental costs for business owners leasing commercial properties, prompting many to consider whether purchasing their property might be a smarter, long-term strategy.

How Does CPI Impact Commercial Property Rentals?

In Australia, many commercial lease agreements are linked to the CPI, with annual rent increases tied to inflation. This means that as the CPI rises, rental costs rise—often significantly.

For example, a CPI increase of 2.8% can translate to higher rent costs, particularly for larger premises. In the current environment, where costs are rising, these annual rental increases can add pressure to already tight budgets.

The Case for Purchasing Your Own Commercial Property

As a business owner, this is a call to reconsider your property strategy, as purchasing a commercial property could provide you with several potential benefits, including:

Cash Flow Stability

Owning a property provides a significant advantage by freeing you from the uncertainties associated with rental costs, which can fluctuate due to changes in the CPI. Fixed mortgage repayments (or predictable finance terms) can bring stability to your cash flow in the long run.

Asset Building

Property ownership provides the opportunity to build equity over time instead of paying rent to a landlord. As the property appreciates in value, it can become a significant asset contributing to your business’s overall net worth. This equity can then be leveraged for future investments, expansions, or improvements, ultimately enhancing your financial stability and growth potential as a business owner.

Long-Term Savings

While upfront costs may be higher than other options, such as renting, purchasing a property can often be more cost-effective over the long term, particularly as property values appreciate.

Increased Flexibility

Owning your own premises provides a greater degree of control than renting. Unlike renting, where landlord restrictions can limit your options, owning your space gives you the freedom to implement modifications and expansions with operational flexibility.

Financing Options Tailored to Your Needs

Purchasing a commercial property is a big decision and investment, and that’s where we come in.

At Ledge Finance, we specialise in helping businesses explore options and secure tailored financing solutions that align with their needs and goals.

Whether you’re considering a long-term purchase or exploring alternatives, we’re here to provide the expertise and support you need to make the right decision.

Is Now the Right Time to Buy for Your Business?

Although the current high-CPI environment may be challenging, it also presents opportunities for businesses to think strategically. If you’re feeling the strain of rising rental costs, now could be the perfect time to consider investing in your commercial property.

Reach out to our team today to explore your financing options and take the first step toward greater financial stability and growth. Contact us to explore your options together.

Please note that the information provided here is general and does not constitute financial, tax, or other professional advice. You should consider whether the information is appropriate for your needs and seek professional advice before making any decisions.