Recent Insights.

29 November 2024

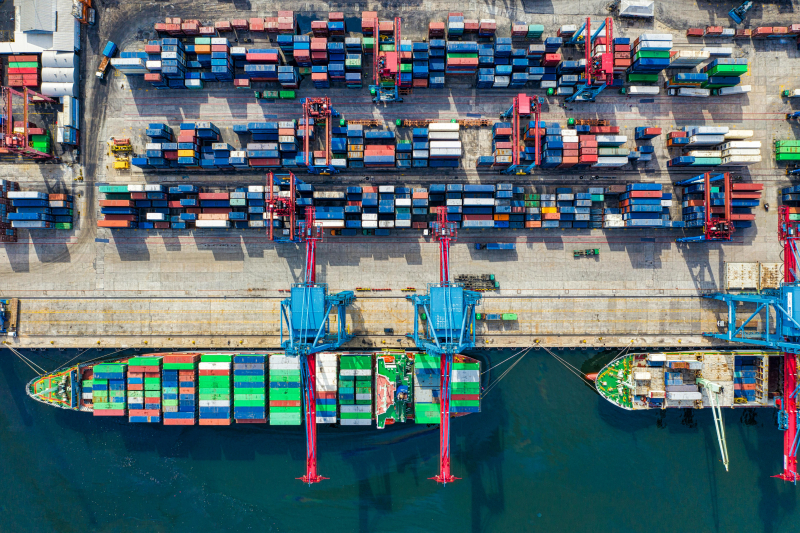

November 2024 Supply Chain Update: Shipping and Logistics in Australia

As the leading freight forwarder in Australia for transporting machinery, equipment, components and parts domestically and internationally, NMT is here this month to provide a supply chain update – particularly on shipping delays as we head into the New Year. Australian Port Congestion Australian break bulk ports across the country have been regularly congested since 2020, starting with the costs of container shipments increasing to over 6000 USD per 20ft – resulting in many shipments being de-consolidated and shipped via break bulk. This was not limited to small machines and cars but also general cargo. Container freight rates were reduced...

13 November 2024

What is a Green Loan? How Green Loans are Revolutionising Australian Business Practices

Let’s explore the growing popularity of green loans in Australia – outlining their purpose, how they work, and how they are helping businesses embrace sustainability while achieving financial success.

30 October 2024

Suvo Strategic Minerals’ Green Innovation in Construction 🌱

As global demand for greener energy solutions grows, businesses like Suvo Strategic Minerals are leading the way in sustainable green innovation in construction.

30 October 2024

AUKUS in Western Australia: Major Naval Hub to Boost Economy and Create Jobs

In a landmark development for Western Australia, the Federal Government has announced the establishment of the largest naval hub in the southern hemisphere at Henderson shipyard as an expansion of AUKUS. New Defence Precinct Announced for Henderson Over the next two decades, the consolidated Commonwealth-owned Defence Precinct at the Henderson shipyard in WA will generate tens of thousands of secure jobs in construction, submarine maintenance, and shipbuilding and establish a significant industrial pipeline for WA businesses. With an initial investment of $127 million for planning and feasibility studies over three years, this work will shape the future delivery models and...

11 October 2024

Top 10 Cyber Security Threats in Australia – And What This Means for Your Business

Let’s explore the top 10 cyber security threats and what they mean for Australian businesses.

9 October 2024

Funding, Support & Government Grants for Businesses Owners to Unlock AUKUS Opportunities

To help businesses seize AUKUS opportunities, the Australian government is rolling out several grants, funding and training programs, and equipment investment initiatives.

25 September 2024

Behind Ever Partnership is a Story: KDMS & Ledge Finance

20 September 2024

AUKUS: A Game-Changer for Western Australian Businesses

The AUKUS agreement represents a prime opportunity for WA businesses to position themselves at the forefront of a transformative economic shift.

11 September 2024

AI Impact on the Workforce: How Will AI Impact Your Business?

Let’s explore the implications of AI on jobs, the economy, and specific industries such as accounting and marketing.