Recent Insights.

3 March 2020

Effective business growth strategies for your business

Growing your business doesn’t happen overnight. In fact, there are many factors that come into play when formulating an effective business growth strategy. The success of your strategy is what will drive your business to not only be a dominant player in your market, but to continue growing. Business growth strategies for your business Business growth strategies will vary from business to business, however the main principles remain the same. Igor Ansoff, also known as the “father of strategic management,” defined these principles in 1957, all of which are still used as reference points for many businesses to this day....

3 March 2020

Supply Chain Finance: A Timeline of Events

In recent months, various media outlets have shown significant interest in the prolific rise of Supply Chain Finance (SCF) and the impact these facilities have on small businesses. In this article, we will explore a timeline of events which occurred over the past year from; companies being accused of “bullying” smaller contractors, to the views of the Australian Small Business and Family Enterprise Ombudsman (ASBFEO), Kate Carnell. Supply Chain Finance – The Facility in More Detail Before we start, let’s take a quick look at SCF… SCF, or ‘reverse-factoring’, is a type of working capital facility provided by specialist financiers...

4 February 2020

Is your business ‘fit’ for finance in 2020?

As changing markets create a new lending environment there continues to be a trend of increased risk aversion by mainstream financial institutions (banks/lenders). In this article we explore how businesses can ensure they are ‘fit’ for finance in 2020 and beyond. Prepare your business’ financial statements It is essential for businesses to have up-to-date financial statements as it provides visibility on the overall performance of the business. Having accurate and timely financial statements can also assist in getting your business ‘fit’ for finance. When applying for finance, financial institutions (banks/lenders) require up-to-date financial statements. Getting these organised can take some...

4 February 2020

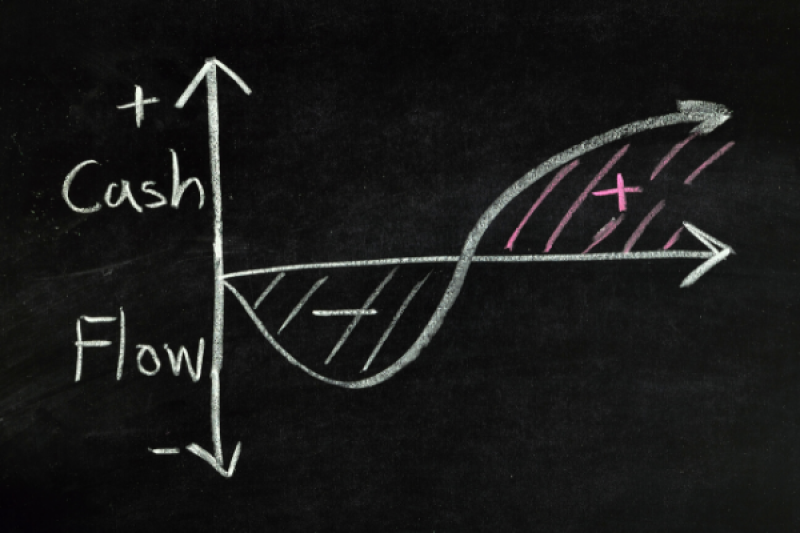

Why is cash flow so important for businesses?

When it comes to running a business of any size, managing its cash flow is crucial. So, why is cash flow so important for businesses and how can you ensure you successfully manage it? In this article we will explore: What is cash flow? Why is cash flow so important? How to analyse cash flow How to finance your cash flow What is cash flow? Put simply, cash flow is the money moving/flowing in and out of your business. Cash flows in from customers who purchase goods and services, money from investors, interest on savings or investments, and so on....

3 December 2019

Prepare your business for the new year

Now is a great time for businesses to reflect on achievements and challenges they faced over the past year and prepare for what’s ahead. To help you prepare for the new year we have put together a few tasks to add to your to-do-list: Review and create new goals This time of year, is a perfect time to review your short-term goals achieved throughout the year, as well as looking at the challenges or negatives you incurred along the way. It’s important to understand when these challenges took place and what you did to resolve them, to give you the...

6 November 2019

5 Lifestyle hacks to improve your energy at work

There is a vast amount of readily available information on how you can increase your health and improve your energy levels, so much so that it can become confusing or in some cases controversial. An article published by the Australian Institute of Company Directors caught our attention, as it explores how a few simple lifestyle hacks can improve your energy at work. The article features Dr Joanna McMillan who explores the idea of “lifestyle medicine” and how it has the power to make a real difference to how you feel, your performance and energy levels for work and leisure, your...

4 November 2019

Ledge Finance: 3-Way forecasting for SME & large businesses

1 October 2019

Growth in the WA mining & resources sector

Australia is starting to see an upturn in the mining and resources sector after ending 2018 with a record-breaking year and continuing this growth into 2019. [1] Western Australia plays a huge part in this success, but there are plenty of discussions around the current skills shortage. Growth in the resources and mining sector The Resources and Energy Quarterly report June 2019, released by the Australian Government, Department of Industry, Innovation and Science reported: “In recent years, we have predicted commodity export earnings would peak in 2018 – 19. As recently as March 2019, we suggested record earnings of $278...

3 September 2019

CAFBA Annual Conference & Awards Night 2019

CAFBA Annual Conference & Awards Night 2019 The CAFBA (Commercial and Asset Finance Brokers Association of Australia) Annual Conference and Awards Night 2019 were held last Friday and what a fantastic day and night of events it was. The main focus for the conference was on innovation and change which is extremely topical in the current market conditions. CAFBA President, David Gandolfo, opened the annual conference by highlighting the role of CAFBA and the key points that would be discussed throughout the morning. These topics included, political and regulatory policies affecting the market, disparity in the market, responsible lending laws...