Recent Insights.

28 September 2021

ESG: What it is & why it should matter to your business

All businesses, whether knowingly or not, are intertwined with the ESG movement. As ESG elements become increasingly visible across the various lenders lending criteria, it will be crucial for businesses to not only understand what ESG is, but also adopt a robust ESG strategy. What is ESG? ESG (Environmental, Social and Governance) factors are core to an organisation’s strategy and operations. They are non-financial factors that investors and lenders use to identify material risks and growth opportunities and include the following. Environmental This relates to a business’s commitment to the natural world both in current projects but also how they...

28 September 2021

The key to making strategic business decisions

Every business owner’s dream is to build a successful business but scaling up a business is a decision that should not be taken lightly. The key here is to ensure the new business opportunity is not only profitable but also sustainable. 5 Most Critical Matters to Consider When Scaling up Your Business Strategy – A strong, thought out strategy that is constantly updated Leadership – Ability to drive change and be a visionary Change – ability to implement and adapt to change Technology – Internal systems being able to keep up with the changes Cash Flow – Ability to fund...

28 September 2021

Westcon “leveling” up

Ledge recently had the pleasure of sourcing finance for Westcon Contracting, a family owned and operated commercial concreting business based in Malaga, for a New Somero® Laser Screed® Machine. Screeding is a smoothing and levelling process involved in the delivery of concrete slabs in the construction industry. Delivered manually on smaller projects, Somero built its first commercial grade Laser Screed in 1986 to automate the process. With only two of its kind in Australia, the Somero model S-22EZ is the most technologically advanced Laser Screed® Machine available in the world. It’s equipped with 360° machine rotation, a 6 metre telescopic...

31 August 2021

Payment times reporting scheme

Are you a large business with a turnover of >$100 then you may need to be ready for the first Payment Times Reporting Scheme (PTRS) report which is due for lodgement on 30 September 2021. The Australian Government appointed the Payment Times Reporting Regulator on 1 January 2021, with the PTRS brought in to help create faster and fairer payment times for Australia’s 3.5 million small businesses. What is the Payment Times Reporting Scheme? PTRS is new legislation that requires larger businesses with a turnover >$100 million to report on their supplier’s payment practices related to small business suppliers with...

27 July 2021

2021 Federal budget summary snapshot

The Federal Budget was announced on 11 May 2021. With a lot of information to digest we thought we would simplify this so that small and medium business owners understand how the budget may impact them. Read on for more or download our 2021 Federal Budget Summary one pager here. For small to medium businesses Temporary full expensing measures extended until 30 June 2023 Businesses with a turnover up to $5 billion will be able to deduct the full cost of any eligible asset they purchase for their business in the tax year the asset was purchased. This includes the...

27 July 2021

Grants worth billions gifted to WA manufacturers

Many businesses have received grants as part of the $1.3 billion Modern Manufacturing Initiative (MMI). The aim of the MMI is to help Australian manufacturing businesses collaborate, scale up and commercialise their product offering. In this blog we explore the MMI in more detail, the 3 different MMI funding streams and manufacturers who have received grants via MMI. The $1.3 billion Modern Manufacturing Fund The Modern Manufacturing Initiative is a key element of the Australian Government’s Modern Manufacturing Strategy, with the goal to enable Australian manufacturers to collaborate, integrate, and expand into wider supply chains, whilst creating jobs, and overall...

29 June 2021

WA WHS Act 2020: Changes that all businesses need to know

A small business owner based in Esperance, has recently become the first person in Western Australia to be jailed for gross negligence. Daren Kavanagh, WA WorkSafe commissioner hopes that this will encourage small business owners to start taking workplace safety seriously. As we start to see a change in how gross negligence cases are dealt with, we are bound to see an industrial manslaughter legislation in WA very soon. In this blog we explore this case in more detail, along with the major changes to the Work Health & Safety Act and how businesses can prepare. Gross Negligence Case of...

29 June 2021

Low interest rates expected to rise

The portion of fixed rate residential lending increased by 50% at the beginning of the RBA easing of the monetary policy when Covid-19 first hit. The RBA originally thought that interest rates would remain low until inflation rose by 2 – 3 %, which isn’t expected until 2024. However, accordingly to a recent AFR article, many Banks bill futures imply that rates may begin to increase sooner than expected. In this blog we explore: Why are interest rates expected to rise? What this means for people with a home loan What this means for people entering the property market How...

29 June 2021

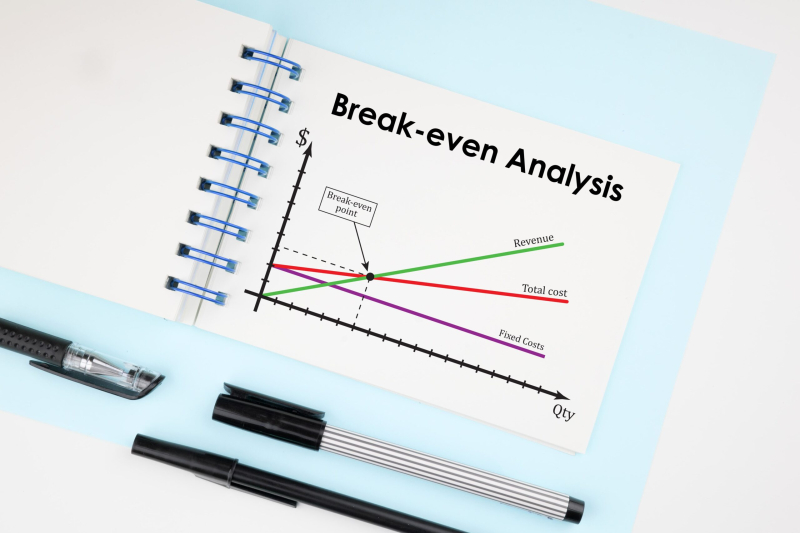

Break-even point analysis & calculation

As a business owner, knowing your breakeven point is so important. It is how you determine whether you’re making profit or not, yet you would be surprised to know that a lot of businesses don’t keep track of all costs involved. In this blog, we explore the importance of understanding your breakeven point, a calculation for businesses to use and the uses and limitations of using a break-even analysis. Key takeaways A breakeven point is the point at which total revenue equals total costs or expenses Fixed and variable costs are used to calculate a break-even point Break even point...