Economic trends can have a significant influence on the success of a business. Whether you’re a startup, small enterprise, or large corporation, understanding the current economic trends is crucial in steering your ship in the right direction.

Let’s delve deeper into the whirlwind of Australia’s economic landscape and decipher what it means for businesses like yours.

Key Economic Trends Driving Change

Resilient Recovery

Australia’s economy has been on a recovery spree, bouncing back from the tumultuous times of the COVID-19 pandemic. With the easing of restrictions, many sectors saw a resurgence in activity which spelt good news for businesses across the board as consumer confidence picked up and spending patterns began to normalise.

Different sectors within Australia are experiencing varying degrees of growth, with industries such as hospitality, tourism, and retail, which were hit hard by lockdowns and travel restrictions, gradually rebounding as consumer confidence returns. Rebuilding customer relationships, enhancing service offerings, and leveraging digital channels to reach broader audiences will be integral to supporting this rebound.

Rising Inflation

One buzzword that’s been making the rounds for a while is ‘inflation’, which has been posing challenges to businesses across the board.

As prices have climbed steadily, fuelled by various factors, including supply chain disruptions, increased demand, and rising raw material, labour and energy costs, businesses need to keep a close eye on costs and pricing strategies to ensure profitability in the face of inflationary pressures.

Moving forward, some considerations for businesses are revisiting pricing strategies, exploring cost-saving measures, and negotiating favourable contracts with suppliers to mitigate the impact of inflation. Additionally, offering value-added services or products may help to offset price increases and maintain customer loyalty.

Labour Market Dynamics

The labour market is another area experiencing significant shifts. While unemployment rates have been dropping, there’s a growing mismatch between job openings and available skills. Businesses may find themselves competing for talent in specific sectors, driving up wages and recruitment costs.

The labour market landscape is evolving rapidly, driven by changing workforce preferences and skill requirements. Businesses should prioritise employee retention and skill development initiatives to attract and retain top talent.

Offering competitive salaries, flexible work arrangements, and opportunities for career advancement can help businesses to stand out in a competitive job market. Embracing diversity and inclusion practices can also foster a more inclusive and productive work environment.

Tech-Driven Transformation

The digital revolution is reshaping industries and disrupting traditional business models. Businesses that invest in technology and innovation will be better positioned to stay ahead of the curve and capitalise on emerging opportunities.

From e-commerce platforms to remote working solutions, investing in digital infrastructure can be a game-changer in today’s economy. And businesses that embrace technology and innovation will be better positioned to adapt to changing consumer preferences and market dynamics.

Whether it’s adopting cloud-based solutions, implementing data analytics tools, or leveraging artificial intelligence, businesses should embrace digital transformation to help improve operational efficiency, streamline processes, and deliver superior customer experiences.

Sustainability and ESG

Environmental, Social, and Governance (ESG) considerations are no longer just buzzwords – they’re becoming integral to business strategy. Consumers are increasingly conscious of sustainability issues, and businesses that prioritise ESG initiatives stand to gain both in terms of brand reputation and long-term viability.

Sustainability has emerged as a key business objective, driven by growing consumer awareness and regulatory pressures. Businesses should integrate environmental, social, and governance considerations into their core business strategies to create long-term value and mitigate risks.

This may involve reducing carbon emissions, promoting workplace diversity, fostering community engagement, and adhering to ethical business practices. By aligning with ESG principles, businesses can enhance their brand reputation, attract socially responsible investors, and drive positive social and environmental impact.

Additional Dimensions of Australia’s Economic Landscape

Consumer Spending Patterns

Consumer spending plays a crucial role in driving economic growth, accounting for a significant portion of Australia’s GDP. Understanding consumer behaviour and spending patterns can provide valuable insights for businesses seeking to target specific market segments and tailor their product offerings.

To anticipate shifts in demand, businesses should keep a close eye on consumer sentiment indicators, retail sales data, and household spending trends, and adjust their marketing strategies accordingly.

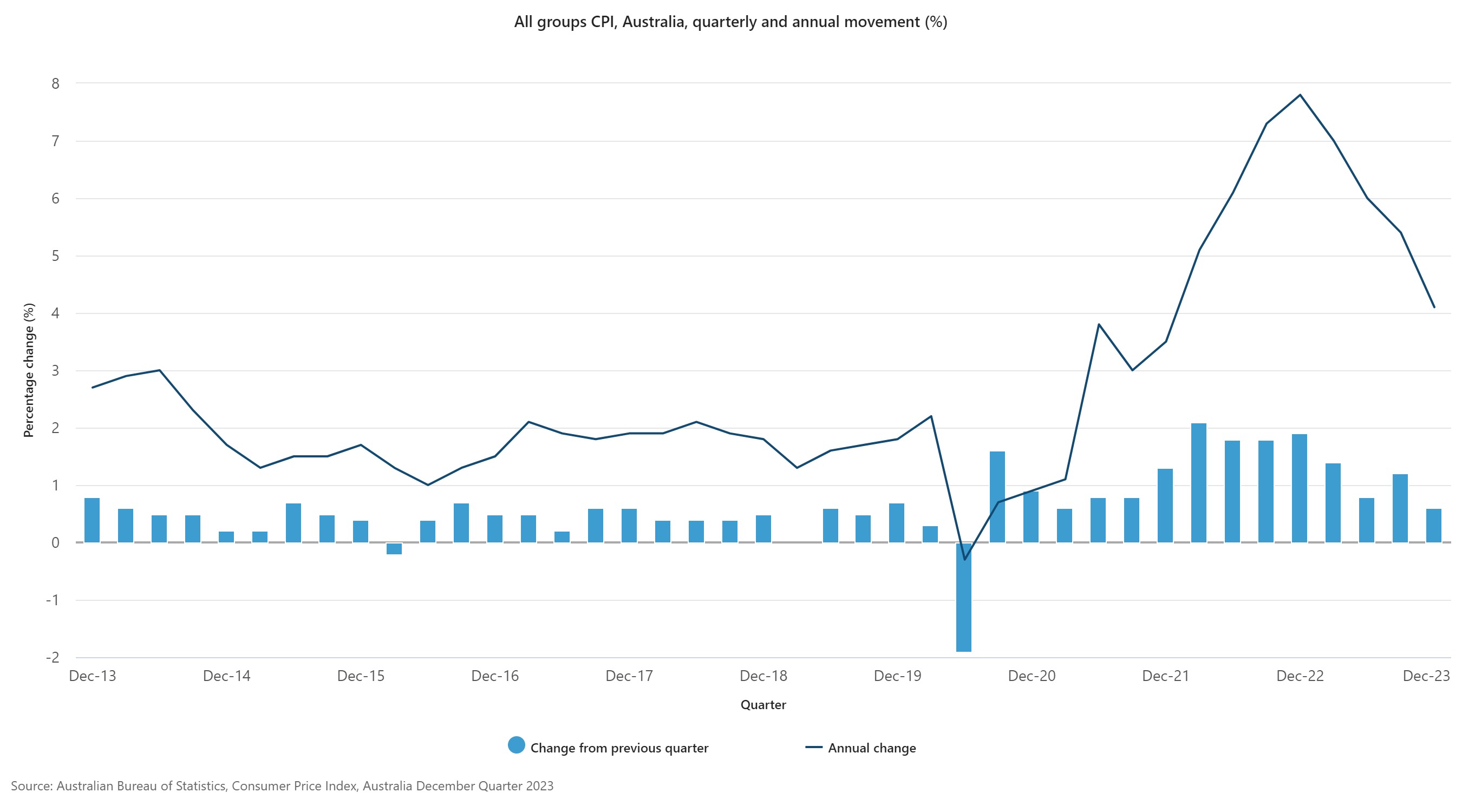

For the December 2023 Quarter, the Consumer Price Index (CPI) rose 0.6%, which equates to a 4.1% rise over the last 12 months. This rise in CPI should prompt businesses to evaluate and potentially adjust their pricing strategies to maintain profitability, protect purchasing power, stay competitive, and strategically position themselves in the marketplace.

Image source: Australian Bureau of Statistics (ABS): Consumer Spending Data

Structural Reforms

Structural reforms play a crucial role in boosting the efficiency and competitiveness of Australia’s economy.

It’s important for businesses to remain up-to-date with government initiatives and policy changes that may impact their operations and strategic planning. Policies aimed at deregulation, tax reform, infrastructure investment, and labour market flexibility can stimulate innovation, productivity, and long-term growth.

Resources on structural reforms in Australia:

- Department of the Treasury: Policy Papers and Updates

- Australian Government: Industry and Business Policy Updates

Monetary Policy

Monetary policy decisions by the Reserve Bank of Australia (RBA) have a significant impact on interest rates, exchange rates, and credit conditions. In turn, this impacts business borrowing costs, investment decisions, and consumer spending.

Businesses need to keep a close eye on key economic indicators, inflationary pressures, as well as RBA announcements, in order to assess the potential implications of the RBA’s monetary policies for their financial planning and operations.

Resources on Monetary Policy and further details:

- Reserve Bank of Australia (RBA): Monetary Policy Statements

- Australian Financial Review: Latest Economic News and Analysis

Wage Growth

Wage growth is an important indicator of economic health and consumer purchasing power. It’s essential for businesses to track wage trends to gain a better understanding of labour market dynamics and anticipate changes in consumer spending behaviour. While an increase in wages can boost demand for goods and services, it can also lead to higher operating costs for businesses

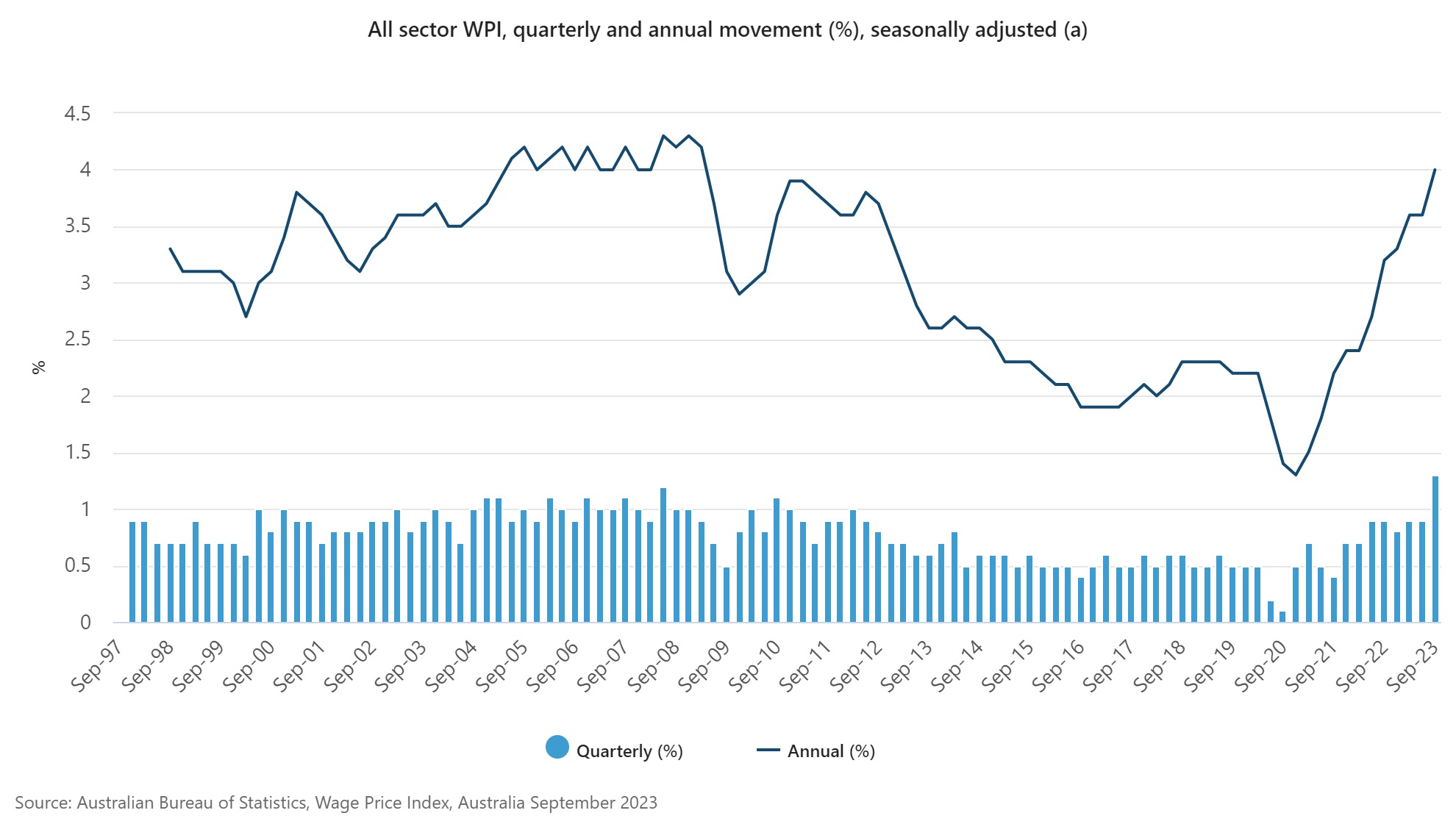

For the September quarter, Australia’s adjusted WPI rose 1.3% for the quarter and 4% over a 12-month period. The industry with the highest impact on this overall rise in WPI was health care and social assistance, which rose 3.1%.

Image source: Australian Bureau of Statistics (ABS): Wage Price Index

Additional resource on wage growth:

- Fair Work Commission: Minimum Wage Updates

Commodity Markets

Commodity markets play a significant role in Australia’s economy, with commodities such as iron ore, coal, gold, and natural gas being major export earners. Fluctuations in commodity prices can impact export revenues, trade balances, and overall economic performance.

Businesses involved in commodity trading or reliant on commodity inputs should closely monitor market trends and geopolitical developments that may affect supply and demand dynamics.

Resources on Australia’s Commodity Markets:

- Australian Government: Department of Industry, Science, Energy and Resources

- Bloomberg Commodities: Commodity Market News and Analysis

Global Economy and Emerging Markets

Global Growth Trends

Global economic growth trends have a significant influence on Australia’s economic performance, given the country’s deep integration into the global economy via trade and investment channels.

To anticipate shifts in global demand and market dynamics, it’s vital for businesses to monitor key indicators of global economic activity, such as GDP growth rates, trade volumes, and investment flows.

Resources on global economic growth trends:

· World Economic Forum. (2023): Global Risks Report

· International Monetary Fund (IMF): World Economic Outlook

Emerging Markets

Emerging markets represent a significant growth opportunity for businesses seeking to expand their global footprint. Countries in Asia, Latin America, and Africa are experiencing rapid urbanisation, growing middle-class populations, and increasing consumer spending power.

However, navigating emerging markets comes with its own set of challenges, including regulatory complexities, cultural differences, and currency fluctuations. Conducting thorough market research and building local partnerships can help businesses to mitigate risks and maximise opportunities in emerging markets.

Resources on emerging markets:

Trade and Supply Chain Dynamics

Global trade patterns and supply chain networks are undergoing a transformation, driven by technological advancements, and shifting consumer preferences.

Diversification of supply chains, reducing dependency on single-source suppliers, and exploring alternative logistics routes to build resilience and mitigate supply chain disruptions are some of the things businesses could consider. Additionally, staying abreast of trade agreements, tariffs, and export-import regulations to capitalise on international trade opportunities and minimise trade-related risks.

Resources on trade and supply chain dynamics:

- World Trade Organisation (WTO): World Trade Statistical Review 2023

- Harvard Business Review: The Radical Reshaping of Global Trade

Geopolitical Risks

Geopolitical risks, such as trade tensions, conflicts, and regulatory changes, can have significant implications for businesses operating in Australia and beyond.

Therefore, it is crucial for businesses to remain vigilant and assess potential geopolitical risks that may impact their supply chains, market access, and investment opportunities.

Resources on geopolitical risks:

Stay on Top of Economic Trends

Navigating Australia’s economic trends requires a holistic understanding of both domestic and global dynamics. By staying informed, adaptable, and proactive, businesses can position themselves for success in an increasingly interconnected world. Embrace innovation, foster resilience, and seize opportunities to thrive amidst the challenges and opportunities of Australia’s economic landscape.

Ledge Finance is one of Australia’s most trusted commercial finance brokers. Our experienced team are on hand to help you source the right financing for your unique requirements.

Please contact us today for further information.

Please note that the information provided here is general and does not constitute financial, tax, or other professional advice. You should consider whether the information is appropriate for your needs and seek professional advice before making any decisions.