Recent Insights.

27 July 2021

Grants worth billions gifted to WA manufacturers

Many businesses have received grants as part of the $1.3 billion Modern Manufacturing Initiative (MMI). The aim of the MMI is to help Australian manufacturing businesses collaborate, scale up and commercialise their product offering. In this blog we explore the MMI in more detail, the 3 different MMI funding streams and manufacturers who have received grants via MMI. The $1.3 billion Modern Manufacturing Fund The Modern Manufacturing Initiative is a key element of the Australian Government’s Modern Manufacturing Strategy, with the goal to enable Australian manufacturers to collaborate, integrate, and expand into wider supply chains, whilst creating jobs, and overall...

29 June 2021

WA WHS Act 2020: Changes that all businesses need to know

A small business owner based in Esperance, has recently become the first person in Western Australia to be jailed for gross negligence. Daren Kavanagh, WA WorkSafe commissioner hopes that this will encourage small business owners to start taking workplace safety seriously. As we start to see a change in how gross negligence cases are dealt with, we are bound to see an industrial manslaughter legislation in WA very soon. In this blog we explore this case in more detail, along with the major changes to the Work Health & Safety Act and how businesses can prepare. Gross Negligence Case of...

29 June 2021

Low interest rates expected to rise

The portion of fixed rate residential lending increased by 50% at the beginning of the RBA easing of the monetary policy when Covid-19 first hit. The RBA originally thought that interest rates would remain low until inflation rose by 2 – 3 %, which isn’t expected until 2024. However, accordingly to a recent AFR article, many Banks bill futures imply that rates may begin to increase sooner than expected. In this blog we explore: Why are interest rates expected to rise? What this means for people with a home loan What this means for people entering the property market How...

29 June 2021

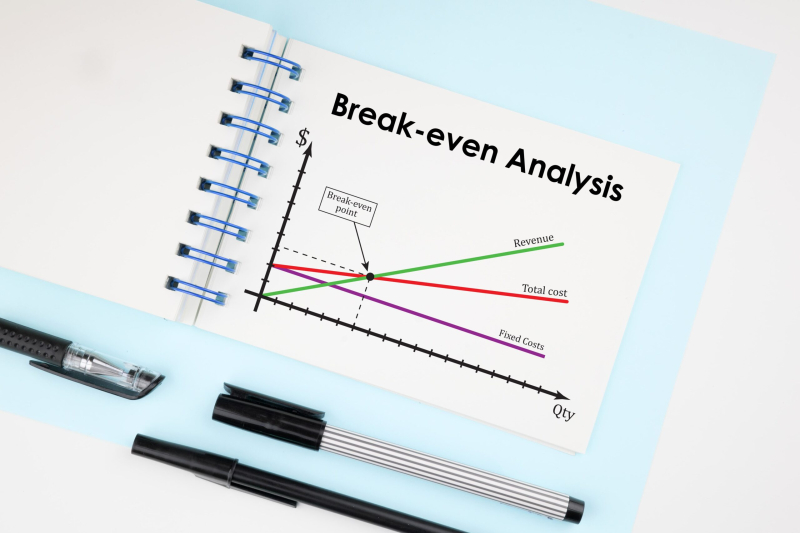

Break-even point analysis & calculation

As a business owner, knowing your breakeven point is so important. It is how you determine whether you’re making profit or not, yet you would be surprised to know that a lot of businesses don’t keep track of all costs involved. In this blog, we explore the importance of understanding your breakeven point, a calculation for businesses to use and the uses and limitations of using a break-even analysis. Key takeaways A breakeven point is the point at which total revenue equals total costs or expenses Fixed and variable costs are used to calculate a break-even point Break even point...

26 May 2021

How to value a business in Australia

If you’re planning to sell or buy a business, knowing how to value the business is critical. And although business value comes to mind more often in relation to selling or buying, there are other reasons why you might want to consider a business valuation. Valuing your business can be beneficial to obtain business financing, attract investors, or for the purpose of exiting the business – something we mentioned in our article on succession planning. Of course, the business valuation task might not be something you would undertake yourself, which is precisely why there are business valuers that have extensive...

26 May 2021

Tax planning for small businesses in 2021

If you’re a business that made use of the instant asset write off then it’s important you have adequate tax planning in place for the upcoming end of financial year. In this blog we explore the various choice to opt out (or not) of temporary full expensing for an income year and what is meant by a loss carry-back tax offset. Temporary Full Expensing extension explained As announced recently on 11 May 2021 as part of the 2021-22 Federal Budget, the temporary full expensing measure will be extended in its current form for another 12 months until 30 June 2023,...

23 April 2021

The importance of strategic focus when opportunities exceed capacity and capability

Clarity on who a business’s target customers are, their value proposition and their unique key capabilities are the foundations for business success and are especially crucial when facing capacity and capability constraints. A challenge facing many West Australian businesses this year is that current market conditions are presenting many more opportunities than there is the capability and capacity to take advantage of these opportunities. Constraints such as retaining and finding staff, and sourcing equipment and supplies are commonplace across many industries. See below a table that shows where; Opportunities are strong and weak in the economy; and There are forces...

29 March 2021

Making home loan finance easy

Delays in home loan approvals coupled with a competitive residential market has increased buyers’ fear of missing out on their dream home. Did you know that pre approvals may not help you secure a home loan? In fact, pre approvals aren’t always necessary if you are wanting to buy a property. In this blog we explore this matter along with: The Difference Between a Standard & Fully-Assessed Pre-Approval What to Consider When Applying for a Pre Approval What is a Preliminary Assessment & how it can help you secure home loan finance How Ledge can put your mind at ease...

9 February 2021

New restructuring options for small businesses in 2021

On 10 December 2020, the Government passed new insolvency laws, which include the extension of the existing COVID safe harbour laws to the 31 March 2021, and the introduction of a new debt restructuring process. Advisors and their small business clients should be alert to these changes and are encouraged to act immediately so they don’t risk trading insolvent or exacerbate existing cash flow problems. In this blog we explore the safe harbour provisions currently in place for businesses, the eligibility criteria for the new restructuring options, as well as the new debt restructuring reforms coming into effect now that...