Recent Insights.

2 October 2020

How to improve your business’ credit score

Funding growth, expansion, or other working capital requirements are always something business owners think about. If you are seeking a business loan facility, your business credit score will indicate your ability to repay the loan. In this article, we explain a business credit score, why you want it to be a good score, what influences it, and tips to improve it. What is a business credit score? Financial institutions (banks/lenders) use your business credit score as an indicator of your creditworthiness. It is calculated using the information listed on your company credit file. In addition to financial institutions assessing your...

1 September 2020

Deferred loan payments: Where to next?

The six-month loan repayment deferrals are due to conclude at the end of September 2020 as Banks enter the next phase of support to assist customers. Whether you are a business or an individual who is currently under a loan deferral structure, you need to know what the next phase entails and what this means for you or your business. The next phase, for most banks, will begin on 1 October 2020, where customers who are able to start paying their loans will be required to do so. Those who are still unable to pay due to ongoing financial difficulty...

4 August 2020

Business loan requirements: What you need to know

There are various finance solutions available for businesses, and the role of commercial finance brokers has become more important now than ever before as we support these businesses and create market clarity. What questions should you ask yourself before applying for a business loan? The best business loan option will vary depending on the type of business and its requirements. Several different loan products are available; it’s a matter of choosing an option to achieve the best outcome. At Ledge, we ensure businesses are fully aware of what options may be best suited to them. To achieve this, we ask key...

7 July 2020

The role of a commercial finance broker

Businesses have faced many challenges over the past few years, and there are bound to be more as we continue to navigate changes within our businesses and the wider market. In this article, we will explore the role of commercial brokers and how they can assist businesses through challenging times. 1. Navigate the changing lending environment In recent years, The Banking and Finance Industry has been subjected to enquiry after enquiry, culminating in the Royal Commission. COVID-19 also impacted many businesses, which has, in turn, affected their ability to secure funding to grow their business. Banks are conducting much deeper...

1 July 2020

Operating cash flow: The core of your business

What is Operating Cash Flow? Operating Cash Flow (OCF) is cash relating to core business activities over time. Ideally, the money coming into the business generated from your service offering (i.e. sales) should be more than operating costs. OCF is used to evaluate the underlying health of the business and to demonstrate the cash generated from normal operations without taking into account secondary sources of revenue, such as investments, finance or the sale of assets. Operating activities explained The various sources and applications of cash included in your OCF are directly related to providing your goods and services to the...

2 June 2020

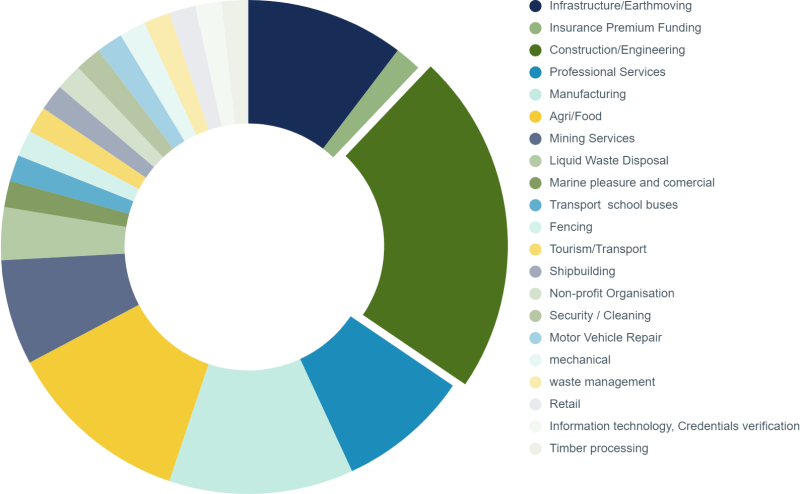

COVID-19 Industry health check survey: the impact on WA businesses

Ledge recently surveyed a number of Perth small businesses (mostly clients and other stakeholders) to get a better understanding of and to provide clarity around how industries have been impacted by COVID-19 and its knock on effects. We surveyed businesses from various industries, including infrastructure/earthmoving, construction/engineering, manufacturing, agri/food and professional services. Whilst the effects of COVID-19 have been widespread across all industries, some businesses have been able to operate as per usual, whereas others have had to innovate and think of new ways to deliver their services. Changes in Operations As a whole, 48.3% of WA businesses surveyed have made...

5 May 2020

10 Tips to lead your business through change

SME’s are the backbone of the Australian economy, and the last few years have especially forced business leaders to think creatively and become more innovative and proactive in the way they deliver their services. Here are 10 practical tips that will help you lead your business through change: 1. Be opportunistic This is a great time to look at your business model and how you’re engaging with your customers. Are there any opportunities within your current product offering to explore new service delivery methods? 2. Balance is key Use your financials to help plan and manage your business cash flow....

7 April 2020

Why you should purchase equipment now?

In these uncertain times, there is one certainty – that the initial economic shock of COVID-19 will eventually pass. The immediate natural human response to any threat is to retreat and bunker down, and that is even more true when the Government’s guidelines reinforce that. However, even though we are socially distancing ourselves and staying home where possible, this doesn’t mean everything needs to stop. In fact, some business leaders are already planning to position their companies ahead of the competition when the shock dissipates. Some business owners are exploring strategic upgrades to their equipment (new trucks, new cranes, etc.),...

7 April 2020

$250k Assistance Loan: What you need to know

Banks have provided more direction around the information that is required for a business to receive an assistance loan. A key point made by banks is that to receive this loan, the business must meet the bank’s assessment criteria. The eligibility and credit criteria Small and medium-sized businesses with a turnover of less than $50 million Available for new lending only from 6 April 2020, approved by 30 September 2020 The business must be based, registered and operating in Australia The loan must only be used to support your current and upcoming business cash flow requirements, including working capital; liquidity;...