How does the cash rate impact banks interest rates?

- The RBA conducts Australia’s monetary policy which includes setting the cash rate on overnight loans in the money market.

- The cash rate influences the banks’ interest rates, however there are many other factors which also affect rates including overall cost of funds, lending risks, competition etc.

- In June 2019, the RBA announced a 0.25% (25 basis points) cut to the cash rate to a historical low of 1.25%. Not all banks followed suit which provoked the usual media outcry.

- Closer analysis would have revealed that the bank which passed on the lowest home loan rate reduction has the lowest headline variable home loan rate (as at 12th June).

- So, rather than focusing on who passed on the full benefit of a reduction in the cash rate (which won’t immediately impact a banks average borrowing costs), borrowers should focus on where they can source the best deal not just from a rate perspective but from a terms and conditions structure perspective.

This rate reduction, the banks response and the media outcry has prompted us to take the time to try and dispel some myths about what influences the banks interest rates.

What is the role of the RBA and what does the cash rate represent?

The RBA “is Australia’s central bank. It conducts monetary policy, works to maintain a strong financial system and issues the nation’s currency”.

The Monetary Policy decision involves “setting the interest rate on overnight loans (known as the cash rate) in the money market. Other interest rates in the economy are influenced by this interest rate to varying degrees, so that the behaviour of borrowers and lenders in the financial markets is affected by monetary policy (though not only by monetary policy).”

What else influences the banks interest rates?

The banks rates are influenced by a variety of factors including (but not limited to) the following:

1. Cost of their funding

Cost of funds and net interest spread are key ways in which many banks make money. The interest rate banks charge on loans must be greater than the interest rate they pay to obtain the funds initially—the cost of funds. Banks source costs of funds for their loans from:

- Own deposits and transaction accounts;

- Domestic ‘open market’ (influenced by the RBA and hence the cash rate); and

- International ‘open market’

2. Risks inherent in lending

These risks include credit risk, liquidity risk involved in funding long-term assets with short term liabilities.

3. Competition in the financial sector

Banks need to remain competitive to ensure they retain their current customers and attract new customers.

4. The banks’ growth strategies

Banks have various growth strategies that allow them to achieve market penetration, market and product development and diversification. These strategies may vary between banks.

5. Rate of return desired by equity holders

This is the return an investor will accept for owning the banks stock, as compensation for a given level of risk associated with holding the stock.

How the cash rate correlates (or not) to the banks’ home loan rates

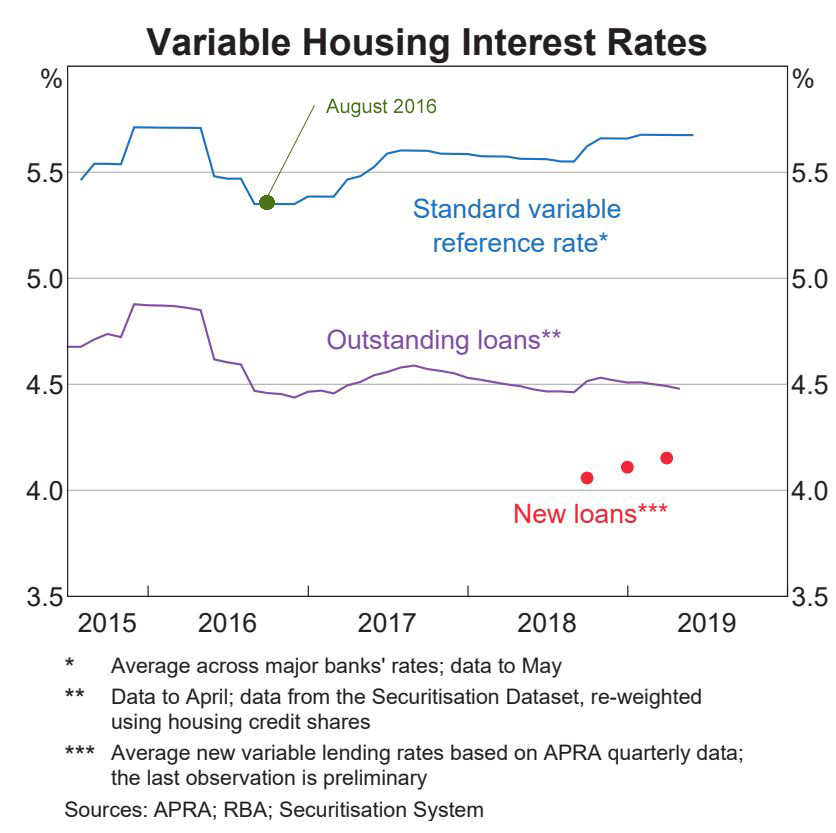

If we take a look at average standard variable housing rates (note that this is the overall average, not the average of the lowest variable rates on offer) of the major banks in recent years (see below graph), it is clear that there has been regular movement in rates (in the range 5.3% to 5.7%) over the selected period, a time when cash rates have remained stagnant at 1.5%.

So, what does this tell us?

Clearly, home loan rates are subject to factors in addition to the RBA cash rate and borrowers and commentators should compare the offers available in the market (dare we say with the support of their friendly finance/mortgage broker 😊) rather than getting hung up on who does what in response to changes to the cash rate.

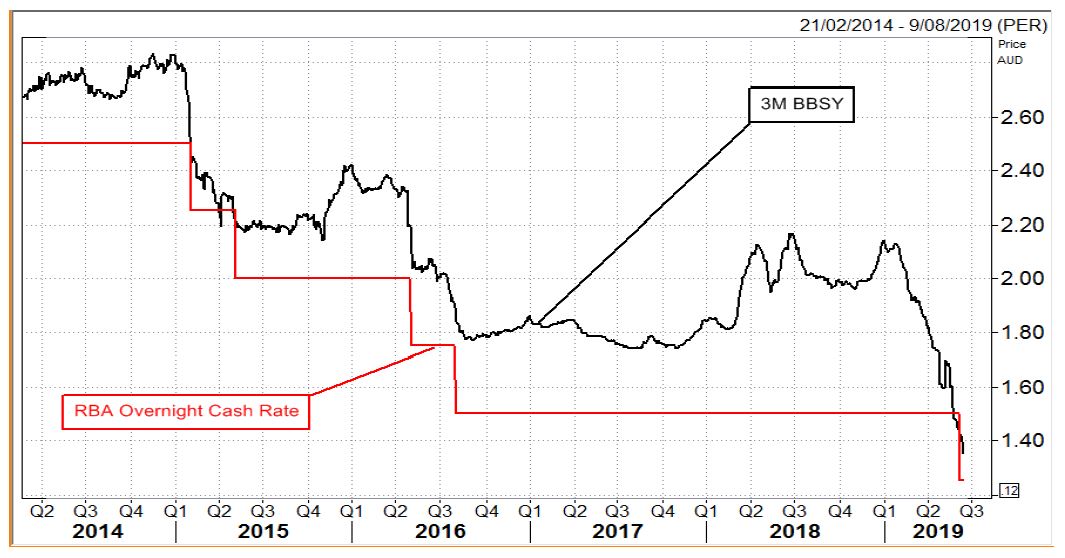

Taking the discussion a little further, is the cash rate correlated with banks commercial lending rates?

The short answer is not necessarily. Whilst the cash rate has some correlation with bank bill swap rates (BBSY – which underpin commercial lending rates), the two often disconnect, as shown in the graph below supplied by NAB. Commercial lending rates are further influenced by a number of other factors including risk ratings, nature of the facility, type of security, finance term etc.

It’s clear that the cash rate isn’t directly correlated to home loan rates and is less correlated with commercial rates.

It’s clear that the cash rate isn’t directly correlated to home loan rates and is less correlated with commercial rates.

So why does the media continue to be so fixated on the cash rate and confusing its readers with commentary that a downward move in the cash rate should be reflected by a corresponding move in home loan rates and possibly, commercial rates?

This goes back to pre-GFC days when there was a more direct correlation. But the GFC changed that forever and banks sources of funds, average cost of funds and operating costs are now far more divergent and will remain so.

If this article has sparked any queries, or you would like to let us know your thoughts, contact our offices here and we will be more than happy to assist.

For more information visit:

Financial Results NAB, Westpac Investor Centre, CBA Investor Results, ANZ Shareholder Centre, rba.gov.au