As a business owner, knowing your breakeven point is so important. It is how you determine whether you’re making profit or not, yet you would be surprised to know that a lot of businesses don’t keep track of all costs involved.

As a business owner, knowing your breakeven point is so important. It is how you determine whether you’re making profit or not, yet you would be surprised to know that a lot of businesses don’t keep track of all costs involved.

In this blog, we explore the importance of understanding your breakeven point, a calculation for businesses to use and the uses and limitations of using a break-even analysis.

Key takeaways

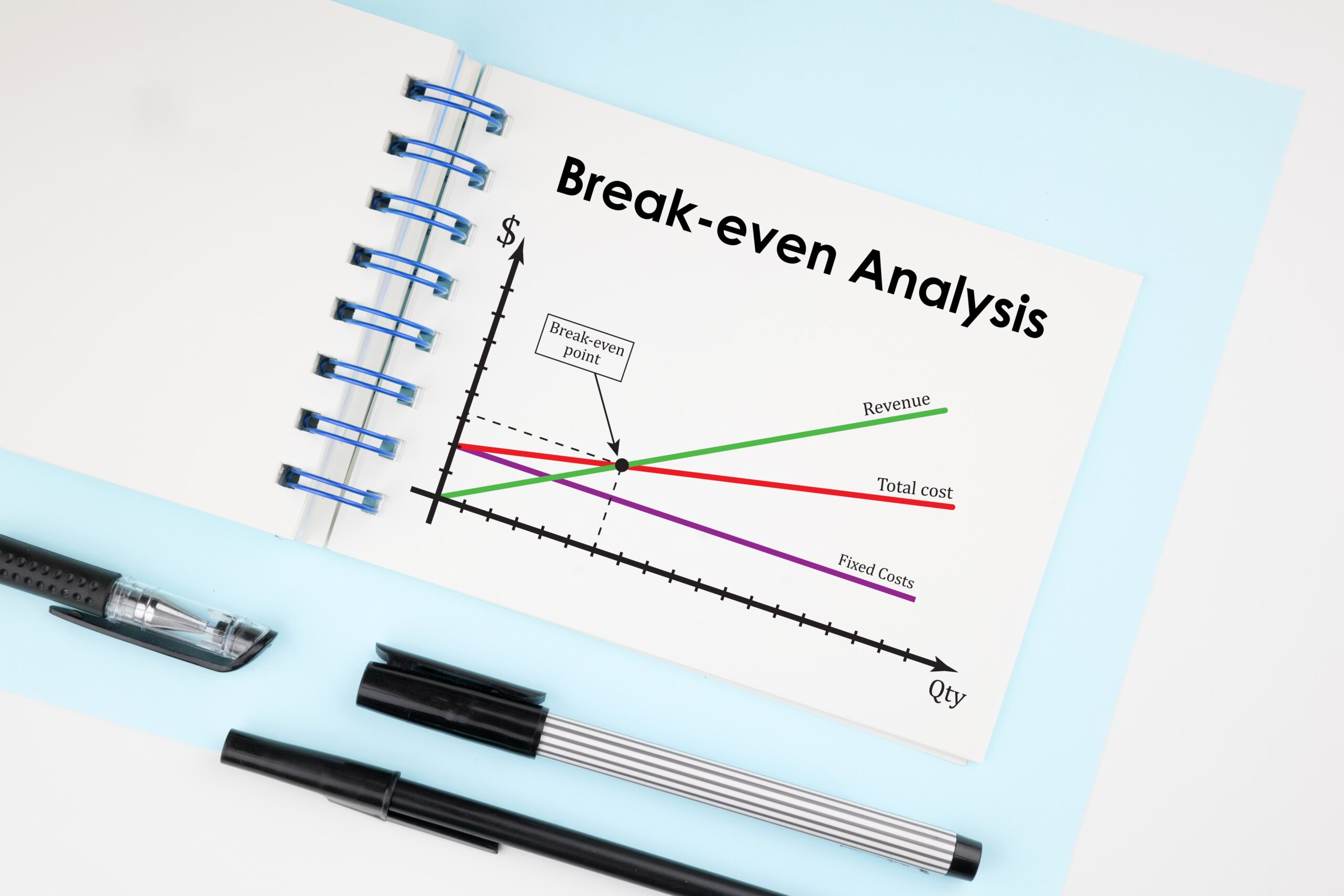

- A breakeven point is the point at which total revenue equals total costs or expenses

- Fixed and variable costs are used to calculate a break-even point

- Break even point equals fixed costs divided by gross profit margin

- Knowing your breakeven point provides you with a benchmark figure, a pricing tool, and a catalyst for business profit improvement strategies

- Break even point analysis does come with limitations

What is a breakeven point?

A breakeven point is the point at which total revenue equals total costs or expenses, or in other words, when you’re spending the same amount on your business as what you’re getting in return. Knowing this point will ensure you know if your business is profitable or not.

What costs are used to calculate a business’ breakeven point?

Both fixed costs and variable costs are used to calculate a business’ break even point.

What is a variable cost?

A variable cost is a cost that continues to change as the quantity of goods or services the business produces changes. When production volumes increase so to will the variable costs and vice versa. Labour costs are an example of variable costs.

What is a fixed cost?

Fixed costs do not change depending on an increase or decrease in production. They are expenses that need to be paid by a business, regardless of whether sales are being made. Examples of fixed costs include rent, insurances, salaries, etc.

How to calculate a business’ break even point?

A business’ break-even point is calculated by dividing fixed costs by gross profit margin.

Break-even point = Fixed Costs ÷ Gross Profit Margin

With Gross Profit Margin = (Sales – Variable Costs) ÷ Sales

For example, if a business has fixed costs of $90,000, sales of $500,000 and variable costs of $320,000 its breakeven point is calculated as follows:

Gross Profit Margin = ($500,000 – 320,000) ÷ $500,000

= 36%

Breakeven ($) = $90,000 ÷ 36%

= $250,000

Hence any sales below $250,000 will result in a loss and any sales above $250,000 will mean the business is making a profit.

Download and save this calculator template by Accendo Financial.

Why is it important to know your break-even point?

You may feel like your business is turning over a lot of money and maybe it is, however, without knowing your break-even point, you may not be making as much profit as you thought.

Knowing your break-even point helps you:

- Determine your product or service viability and whether it is profitable

- Understand how far sales can decline before you experience a loss and how many sales you need to make to build profit

- Enables you to properly price and quote jobs to ensure all costs are absorbed

Your business’ break-even point should be analysed on an annual basis or when there is a major change in your business – an increase in fixed costs (rent, equipment, insurance, etc.) as an example.

What are the benefits of using a break-even point analysis?

Conducting regular break-even analysis comes with many benefits.

Assists with management decisions

Your breakeven point is important in providing insights about business performance and forecasting, which ensures that decisive management decisions can be made.

Pricing strategy

Knowing your break-even point allows you to set long term pricing strategies. For example, once you have paid off the initial production costs and reached a break-even point, you may make the decision to place your product/service on sale and sell a higher quantity than what you would if it was full price. It also helps to see clearly whether you’re covering your fixed costs and if you need to change your overarching pricing strategy or not.

Attract investors

Potential investors want to know what point they will start to see a return. In a lot of cases, this will determine whether the investor choses to invest or not. For start-ups the break-even point is an educated estimate and is often not met for a year or even several years depending on the product/service and the market demand.

Marketing strategy

If you decide to take up paid marketing efforts, add the cost of the marketing to the overhead costs which will give you your new break-even point for the time the marketing campaign is running. That way you know if the marketing strategy worked or not.

Maintain and fund your business

If your business continually experiences a loss, there will come a time where you may have to call it quits. Knowing your break-even point means you can stay on top of your financials and ensure you are able to continue to fund the business.

When to use a break-even point analysis?

You should conduct a break-even analysis annually or whenever there is a big change happening.

Starting a new business

Knowing your fixed and variable costs from the get-go ensures you understand at what point you will begin to make profit. This is particularly important if you are seeking investor support to get started.

Adding a new product or service to the mix

Creating a new product or service can sometimes be a daunting task, as it is an additional expense and you don’t know if it’s going to succeed. Understanding your break-even point can set your mind at ease and will ensure you set the correct price point for the new product.

Change in business model

If you are making changes to your business model or plan to do so, using a break-even analysis can help you determine if your prices need to change to stay inline with a potential increase or decrease in costs.

What are the limitations of using your break-even in practice?

- It can be hard to decipher if costs are fixed or variable, making it tricky to pinpoint your break-even point

- It assumes that selling prices are the same at all levels of production output, which may not be true if things like market demand, supply, and competition change

- It assumes that fixed costs remain the same at all levels of production, however fixed costs may change if the demand and supply increases or decreases

- It assumes that variable costs change in line with the volume of output, however this isn’t always the case

Please note: This is only a concise list of limitations. With these limitations in mind, if you are conducting a break even analysis and using it as a performance benchmark you will need to reassess the numbers on a regular basis, especially if there are any major changes in the business or product/service offering.

It’s important to note that every business is different depending on the type of product and service they offer, hence, there is no use comparing the break-even point of two different industries.

If you have any questions regarding your business’ break-even point and understanding your financials, contact your Ledge Finance Executive directly or call our offices on (08) 6318 2777 or email secure@ledge.com.au.

At Ledge, we work with a number of key stakeholders to provide our clients with a holistic approach to their finances. For us, it’s not just about a business’ finance, It is everything combined that ensures a business can achieve its growth goals.